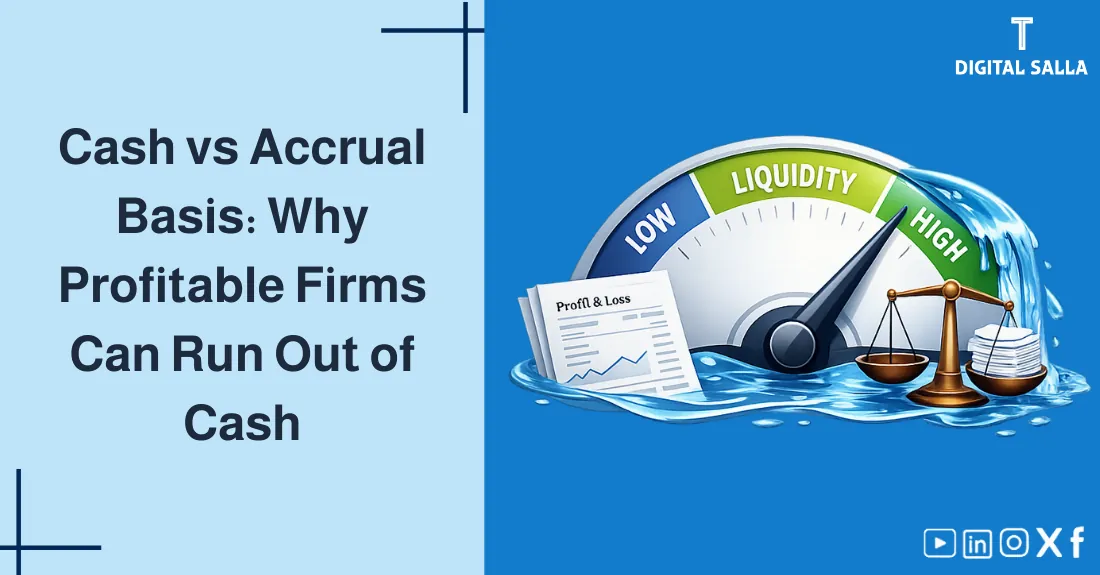

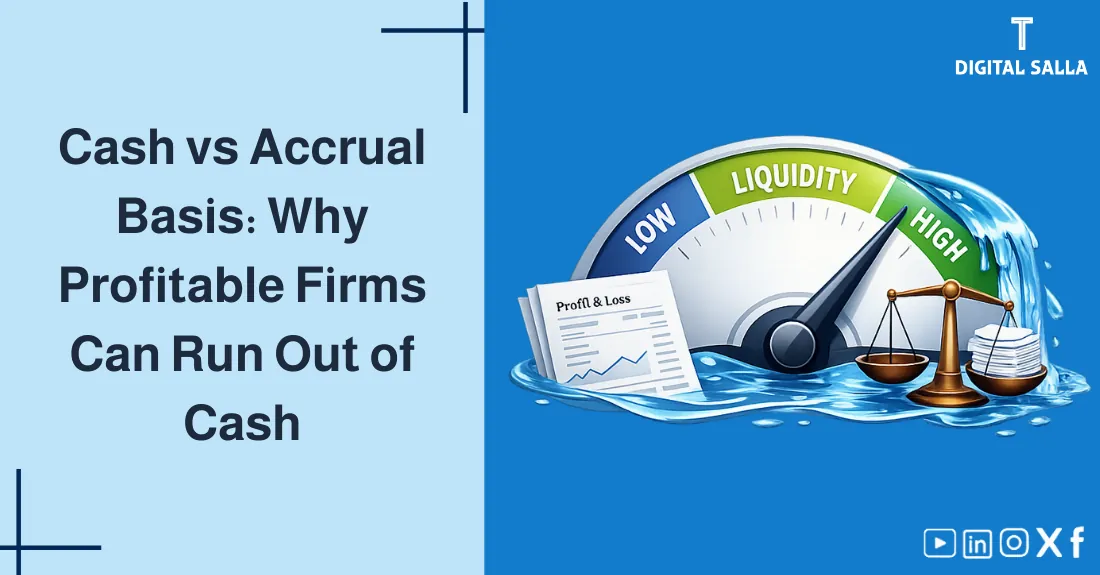

Cash Basis vs Accrual Basis: Why do profitable companies collapse due to liquidity?

Cash Basis vs. Accrual Basis: Why Profitable Companies Collapse Due to Liquidity?

You might have a million in “Accounting Profit” but find your “Bank Balance” is zero. This paradox is the core of the struggle between the Cash Basis and the Accrual Basis. While the cash basis is simple and focused on survival, the accrual basis is a realistic mirror of performance and growth. In this article, we explain the difference between the two bases: Which is better for your company? How does each affect your financial statements? and when is transitioning to the accrual basis a matter of life or death for your business?

- A clear definition of Cash Basis and Accrual Basis.

- Detailed comparison table (Timing, Accuracy, Legal Requirements).

- Why the Accrual Basis is the global standard for growing companies.

- Visual model (SVG) explaining the Liquidity Gap problem.

- Interactive Tool: Evaluate which basis suits your business current needs.

- A 5-step roadmap for transitioning from Cash to Accrual without data loss.

1) Quick Definition of Both Bases

- Cash Basis: You record revenue only when you touch the cash in your hand or bank, and record expenses only when you actually pay the money.

- Accrual Basis: You record revenue when you complete the service or deliver the product (even if payment is later), and record expenses when they are incurred (even if payment is later).

2) Core Comparison Table

| Feature | Cash Basis | Accrual Basis |

|---|---|---|

| Revenue Timing | Upon receiving cash | Upon earning (delivery) |

| Expense Timing | Upon paying cash | Upon incurrence (use) |

| Financial Accuracy | Low (doesn’t match effort/period) | High (realistic mirror of activity) |

| Management Complexity | Very Simple | Higher (requires adjustments) |

| Suited for… | Individuals, micro-businesses | SMEs, Large Corp, IFRS/GAAP |

| Audit/Investors | Generally Not Accepted | The Professional Standard |

3) Cash Basis: Simple but Distorted

The Cash Basis is like a “Checkbook.” It tells you exactly how much money is available for spending.

- Pros: No need for complex accounting knowledge; avoids paying taxes on money not yet collected.

- Cons: Highly misleading for seasonal businesses. (e.g., paying 6 months rent in Jan makes Jan look like a massive loss, while Feb looks like 100% profit).

4) Accrual Basis: Accurate but Needs Liquidity Care

The Accrual Basis follows the Matching Principle: matching revenues with the expenses used to generate them in the same period.

- Pros: Gives a consistent trend of profitability; allows for realistic budgeting and performance tracking.

- Cons: Can show a large profit on paper while the company is “Cash Poor,” requiring a separate Cash Flow Statement to manage survival.

5) Visual Logic: The Liquidity Gap

7) Interactive Decision Support Tool

Answer these 5 questions to see which basis is most mandatory for your current stage:

Accounting Guidance Playbook - PDF File

8) When and How to Switch to Accrual?

The transition usually happens when the “Information Gap” becomes too large to ignore.

- Inventory Count: Proving the value of assets not yet sold.

- Receivables/Payables Aging: Listing all uncollected/unpaid items.

- Prepayments/Accruals Audit: Identifying rent/insurance paid in advance or salaries owed.

- Adjusted TB: Creating the first trial balance that includes these adjustments.

- Parallel Run: Tracking both for one quarter to understand the profit vs. cash gap.

9) Frequently Asked Questions

Why do profitable companies collapse due to liquidity?

Because the Accrual Basis shows they are “winning” on paper, but if they don’t collect cash fast enough to pay salaries and suppliers, they physically stop operating despite their profit.

Can I use Cash Basis for management and Accrual for taxes?

Usually, it’s the opposite. Professional management needs the Accrual basis to see the truth, while some tax authorities allow Cash basis for small businesses.

10) Conclusion

The summary is simple: The Cash Basis is a great tool for managing today’s survival, but the Accrual Basis is the only tool for managing tomorrow’s growth. By understanding the gap between your accounting profit and your bank balance, you protect your business from the “Profitable Bankruptcy” trap.