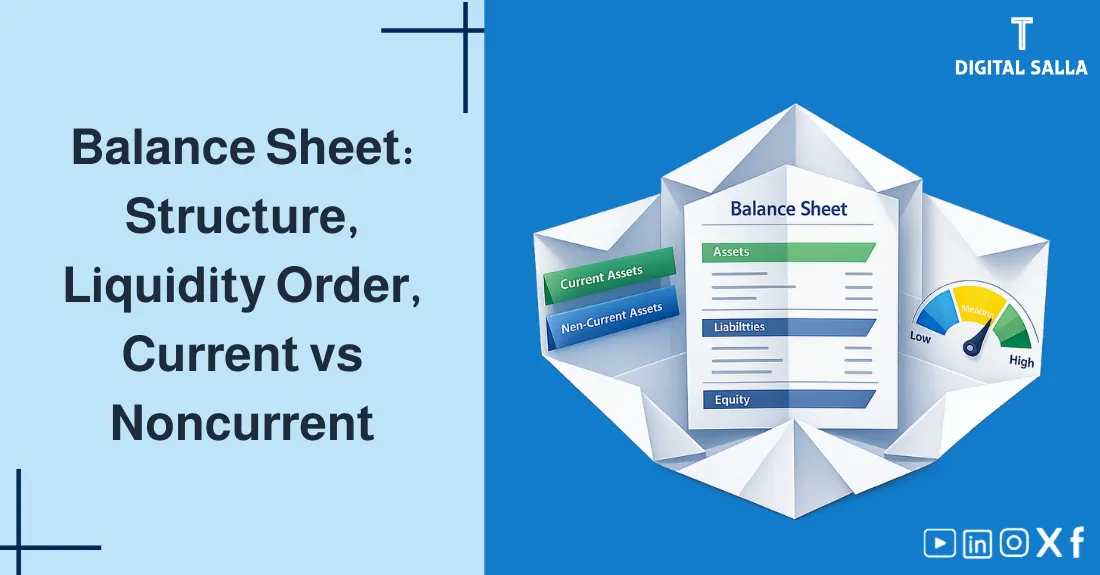

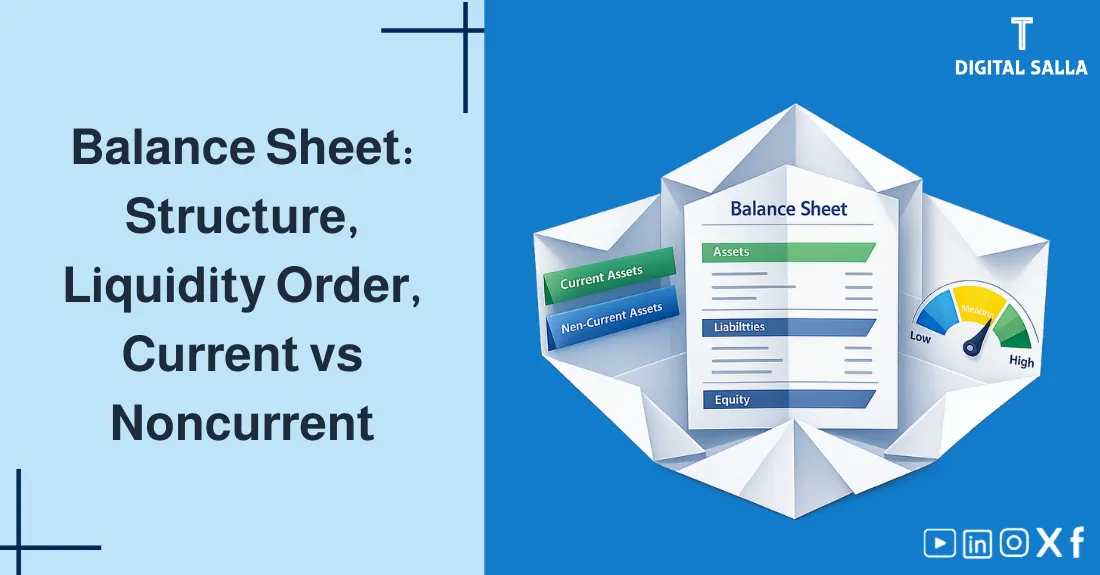

Balance Sheet: Structure, Liquidity Order, and the Difference Between Current and Non-Current

Statement of Financial Position (Balance Sheet): Structure, Order of Liquidity, and Classification

If the Income Statement is a “Video” showing a company’s performance over a year, the Statement of Financial Position (or Balance Sheet) is a “Photo” of its health at a specific moment. It answers the most critical question for any stakeholder: “What does the company own, and who owns it?” In this guide, we provide a professional breakdown of the Balance Sheet: How are assets and liabilities classified? What is the “Order of Liquidity”? And how do you use Working Capital to assess whether the company can survive the next 12 months?

- Simplified definition of the Statement of Financial Position.

- Detailed classification of Current Assets vs. Non-Current Assets.

- Understanding Liabilities and their settlement timing.

- Visual model (SVG) explaining the Order of Liquidity logic.

- Equity components: Capital, Reserves, and Retained Earnings.

- Interactive Tool: Calculate Working Capital and the Current Ratio.

- A checklist for reviewing the quality of balance sheet items.

1) What is the Statement of Financial Position?

It is a formal financial report that provides a snapshot of a company’s economic resources (Assets) and the sources of funding for those resources (Liabilities and Equity) at a specific point in time.

2) Asset Classification: What we own

Assets are classified based on the Operating Cycle (usually one year):

- Current Assets: Expected to be converted to cash or consumed within 12 months (e.g., Cash, Bank, Inventory, Accounts Receivable).

- Non-Current (Fixed) Assets: Long-term investments and physical assets held for use, not for resale (e.g., Land, Buildings, Equipment, Patents).

3) Liability Classification: What we owe

Liabilities follow the same timeline logic:

Finance Glossary - PDF File

- Current Liabilities: Debts due for payment within one year (e.g., Accounts Payable, Short-term Loans, Accrued Salaries).

- Non-Current Liabilities: Long-term obligations due after one year (e.g., Bank Mortgages, Long-term Bonds).

4) Equity: The Residual Interest

This section represents the owners’ net investment in the company. It includes:

- Paid-in Capital: The amount investors originally paid for shares.

- Retained Earnings: Accumulated profits not yet distributed as dividends.

- Reserves: Statutory or voluntary amounts set aside for strengthening the company.

5) Visual Logic: The Liquidity Ladder

6) Liquidity Ranking Logic

Why do we rank items by liquidity? To help analysts quickly determine the company’s ability to settle its obligations. If the company has $1M in assets but $900k is tied up in “Land,” it might still struggle to pay $50k in “Monthly Salaries.” This is the difference between Solvency and Liquidity.

7) Interactive Liquidity Analyzer

Enter your balance sheet totals to evaluate your short-term health:

8) Key Ratios from the Balance Sheet

- Working Capital (Current Assets – Current Liabilities): Measures the cushion available for operations.

- Current Ratio (Current Assets / Current Liabilities): Ideally should be above 1.0 (indicating Assets cover debts).

- Debt-to-Equity: Measures how much the company relies on debt vs. owners’ money.

9) Frequently Asked Questions

Can the Balance Sheet be for a full year?

No. It is always “As of” a specific date. The Income Statement is for a period (e.g., Year 2024), but the Balance Sheet is for a point (e.g., Dec 31, 2024).

Is “Inventory” always a current asset?

Yes, for most commercial companies, because it is held specifically for sale within the normal operating cycle.

10) Conclusion

The summary is simple: The Statement of Financial Position is the ultimate report of Financial Stability. By mastering the classification of items and understanding the order of liquidity, you move beyond just “Matching Numbers” to Managing Survival and planning for sustainable long-term growth.