Cost Allocation: Traditional Method vs Activity-Based Costing (ABC)

Cost Allocation: Traditional Methodology vs. Activity-Based Costing (ABC)

Cost Allocation: Comparing Traditional methods with ABC Costing, how to determine overhead rates, and use Cost Centers to allocate costs fairly and improve pricing decisions—Digital Salla.

- What is Cost Allocation and why is it the biggest challenge in management accounting?

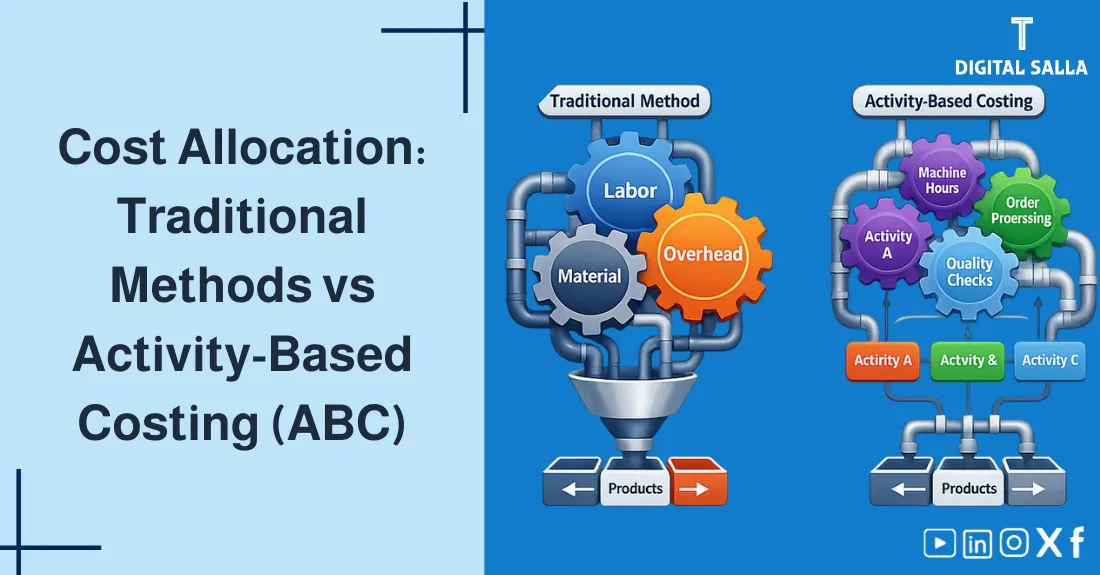

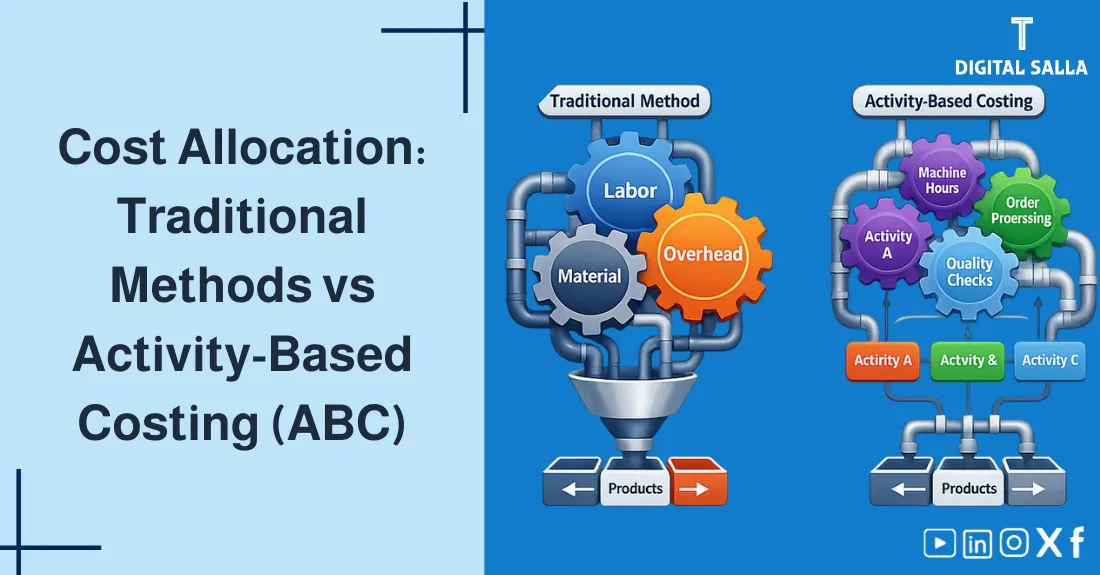

- The Traditional Method: Single plant-wide rates vs. departmental rates.

- Activity-Based Costing (ABC): How to build “Cost Pools” and identify “Activity Drivers.”

- Direct comparison: When does the traditional method fail?

- How to calculate the Predetermined Overhead Rate and handle under/overapplied overhead.

1) The Concept of Cost Allocation

Cost Allocation is the process of assigning indirect costs (like rent, electricity, management salaries) to cost objects like products or services. While direct costs are “Traced,” indirect costs must be “Allocated” using a logical bridge.

2) Traditional Method (Volume-Based)

This is the simplest method. It assumes that products consume overhead in direct proportion to a single volume metric.

2.1 Predetermined Overhead Rate (POHR)

POHR = Estimated Total Overhead / Estimated Total Base (e.g., Direct Labor Hours).

- Pros: Simple to apply, low cost of implementation.

- Cons: Often inaccurate for companies with diverse product lines or high automation.

3) Activity-Based Costing (ABC)

The ABC System recognizes that “Activities Consume Resources” and “Products Consume Activities.” It breaks down overhead into multiple “Pools” based on activity type.

Customer/Product Profitability - Excel Template

4) Comparison: Traditional vs. ABC

The ABC System usually uncovers “Product Cross-Subsidization,” where high-volume simple products “Pay” for the overhead of low-volume complex products.

| Aspect | Traditional | ABC |

|---|---|---|

| Cost Drivers | Single, volume-based (Labor/Machine hrs) | Multiple, activity-based (Setups/Orders) |

| Accuracy | Lower (Good for simple lines) | Higher (Best for complex/diverse lines) |

| Cost to Implement | Low | High (Requires detailed tracking) |

| Decision Support | May lead to under/overpricing | Provides precise margin analysis |

5) Choosing the Right Allocation Base (Driver)

The “Driver” must have a Cause-and-Effect relationship with the cost.

- Procurement Cost: Allocation base = Number of Purchase Orders.

- Factory Electricity: Allocation base = Machine Hours.

- Quality Control: Allocation base = Number of Inspections.

6) Underapplied and Overapplied Overhead

Since Predetermined Rates use estimates, there will always be a difference at year-end.

- Underapplied: Actual Overhead > Applied Overhead (Costs were underestimated).

- Overapplied: Actual Overhead < Applied Overhead (Costs were overestimated).

7) Cost Centers: Service vs. Production

Indirect costs often flow from Service Departments (HR, Maintenance) to Production Departments (Assembly, Finishing) before reaching the product.

- Direct Method: Service costs allocated directly to production departments (ignores inter-service usage).

- Step-Down Method: Allocates service costs sequentially (recognizes some inter-service usage).

- Reciprocal Method: Fully recognizes all interactions between departments (Most complex).

8) Operational Controls & Readiness Checklist

To ensure Cost Allocation fairness:

Allocation Quality Gate Checklist

- Is the POHR updated annually based on a new budget?

- In ABC, is the “Activity Dictionary” reviewed for obsolete activities?

- Are direct labor hours matched with the Payroll Register?

- Are “Cost Pools” clean of non-manufacturing (period) costs?

- Is the variance between applied and actual overhead monitored monthly?

9) Common Errors and How to Prevent Them

- Using Sales Dollars as a Base: This is a circular logic (High price gets more cost) and doesn’t reflect actual resource consumption.

- Ignoring Idle Capacity: Allocating total fixed costs based on actual low volume (leads to artificial unit cost spikes).

- Allocating Admin Costs to Product: General HQ rent is a Period Cost and should not be in the factory overhead pool.

10) Frequently Asked Questions

What is Cost Allocation?

It is the process of assigning shared indirect costs to specific products, services, or departments using a logical bridge or base.

Is ABC always better than Traditional Costing?

ABC is more accurate for complex environments, but if a company has one product and simple processes, the cost of ABC implementation may outweigh its accuracy benefits.

What is a Cost Driver?

It is the factor that causes a change in the cost of an activity (e.g., machine hours drive electricity cost).

11) Conclusion

Mastering Cost Allocation is the foundation of “Decision Integrity.” By moving from arbitrary plant-wide rates to more refined Activity-Based or Departmental rates, you ensure that every product carries its fair share of the burden. This visibility allows you to drop unprofitable products, optimize production activities, and set prices that truly protect your bottom line.

Action Step Now (30 minutes)

- Check your current Overhead Rate—what is the base? (Is it just labor hours?)

- Identify one “Indirect Cost” that feels unfairly allocated (e.g., huge electricity bills shared by volume).

- Brainstorm a more logical Cause-and-Effect driver for that cost.