Internal Audit: Methodology and added value

Internal Audit (IA): Methodology and Institutional Added Value

Internal Audit (IA): A professional guide explaining the role of Internal Audit, its methodology from the Charter to planning, evidence gathering, and issuing reports that protect the organization and improve risk management—Digital Salla.

- Fundamental definition: Internal Audit vs. External Audit.

- The Internal Audit Charter: Independence and Reporting lines.

- The 4 Stages of an Audit Engagement: Planning, Execution, Reporting, and Follow-up.

- Methodology for gathering Audit Evidence (Sampling and Inquiry).

- Writing an effective Audit Report: The 5 C’s (Condition, Criteria, Cause, Consequence, Corrective Action).

1) What is Internal Audit? (The Strategic Definition)

According to the Institute of Internal Auditors (IIA), Internal Audit is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations.

2) Independence and Reporting Lines

For IA to work, the Chief Audit Executive (CAE) must have Dual Reporting:

- Functional Reporting: Directly to the Audit Committee (To ensure independence from management).

- Administrative Reporting: To the CEO (For day-to-day resource needs).

3) The Internal Audit Charter

The Audit Charter is the formal document that defines the IA function’s purpose, authority, and responsibility. It grants the audit team unrestricted access to all records, personnel, and physical properties.

Control Testing Workpapers Pack - Word & Excel Files

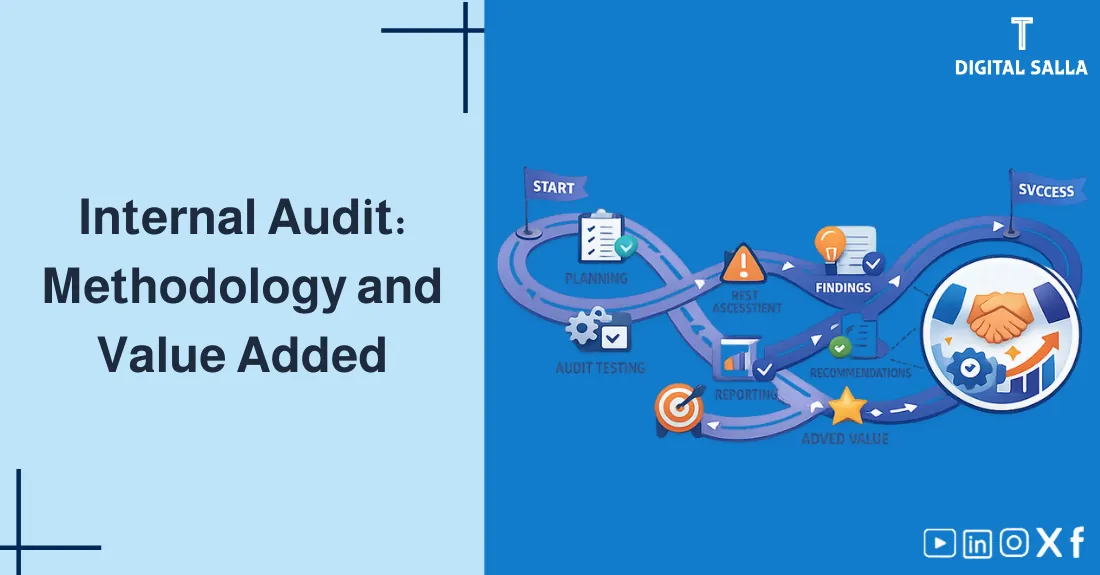

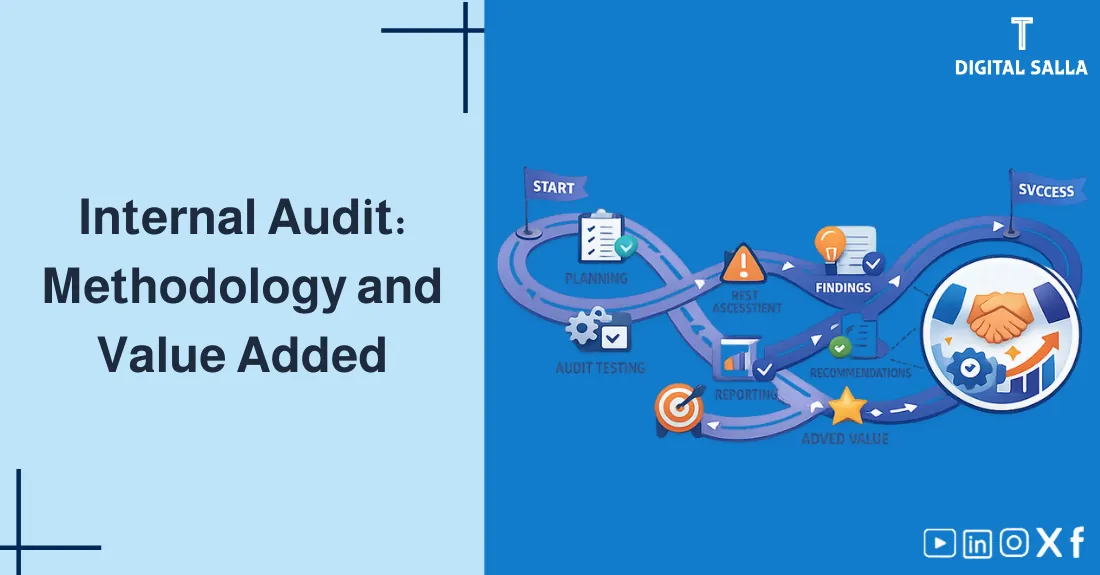

4) Methodology: The 4 Stages of an Engagement

Every audit project must follow these disciplined steps:

- Planning: Defining the scope, objectives, and performing a preliminary risk assessment of the area being audited.

- Fieldwork (Execution): Testing controls, observing processes, and gathering data.

- Reporting: Discussing findings with management and issuing the final report.

- Follow-up: Ensuring management has implemented the agreed-upon corrective actions.

5) The Audit Workflow (Visual Logic)

How an audit moves from “Risk” to “Improvement”?

6) Fieldwork: Gathering Professional Audit Evidence

Auditors use various techniques to ensure their findings are backed by facts:

- Inquiry: Interviewing personnel.

- Observation: Watching a process (e.g., inventory count) in action.

- Inspection: Reviewing physical documents (Invoices, POs).

- Vouching: Selecting a record in the GL and finding the original source document.

- Tracing: Selecting a source document and finding it recorded in the GL.

7) Effective Reporting: The 5 C’s Rule

A high-quality audit finding must explain five things to management:

- Condition: What is the current problem?

- Criteria: What should be happening? (Policy/Standard).

- Cause: Why did the gap happen?

- Consequence: What is the risk/loss to the company?

- Corrective Action: What is the auditor’s recommendation?

8) Operational Controls & Readiness Checklist

To evaluate the maturity of your Internal Audit today:

IA Quality Gate Checklist

- Is there an annual Audit Plan approved by the Audit Committee?

- Do auditors maintain “Working Papers” for every test performed?

- Is the IA team free from performing “Operational Tasks” (e.g., they shouldn’t record accounting entries)?

- Are Whistleblower tips investigated independently by the IA team?

- Does the CAE have a private meeting with the board at least twice a year?

9) Common Errors and How to Prevent Them

- Lack of Technical Skill: Auditing IT systems without an IT auditor. Solution: Hire specialized skills or outsource IA.

- Adversarial Relationship: Treating IA as the “Police.” Pro Tip: Focus on “Collaborative Improvement” to get management buy-in.

- Sampling Bias: Auditing only the easy documents. Solution: Use Statistical Sampling or CAATs (Computer Assisted Audit Techniques).

- Reporting only Negatives: Forgetting to mention areas where management has excellent controls.

10) Frequently Asked Questions

What is an Internal Audit Charter?

It is a formal document that defines the Internal Audit activity’s purpose, authority, and responsibility, signed by the Board/Audit Committee.

Is Internal Audit mandatory?

For publicly listed companies and financial institutions, it is usually a regulatory requirement. For private firms, it is a strategic “Best Practice” to manage risk.

What are CAATs?

Computer Assisted Audit Techniques are software tools (like ACL or specialized Excel macros) used by auditors to analyze 100% of the data instead of just small samples.

11) Conclusion

Internal Audit is the “Ultimate Sentinel” of an organization. By utilizing a risk-based methodology and maintaining strict Independence, the IA function provides the board with the assurance needed to navigate complex markets. It transforms financial and operational oversight from a “Compliance Burden” into a strategic engine for institutional excellence, error prevention, and sustainable value creation.

Action Step Now (30 minutes)

- Find your company’s Internal Audit Charter (if it exists).

- Identify the top 3 high-risk areas in your department.

- Check: Has an internal audit been performed in these areas in the last 12 months? If not, request a “Preliminary Review.”