Real accounts (balance sheet) vs nominal accounts (income): differences and closure

Real vs. Nominal Accounts: Differences and Closing Procedures

In accounting, not all accounts are created equal. Some accounts “live” with the company throughout its entire life, while others “die” at the end of every year to be born again. Understanding the difference between Real (Permanent) Accounts and Nominal (Temporary) Accounts is the key to understanding how the Balance Sheet and the Income Statement are prepared, and more importantly, how the Closing Process works to transfer profits to owners.

- A clear definition of Real Accounts (Permanent) and which financial statement they belong to.

- A clear definition of Nominal Accounts (Temporary) and their role in measuring profit.

- A comparison table summarizing the core differences.

- Visual model (SVG) explaining the data workflow during year-end closing.

- The logic of Closing Entries: Why and how do we reset accounts to zero?

- Practical examples of closing journal entries.

1) Quick Definition

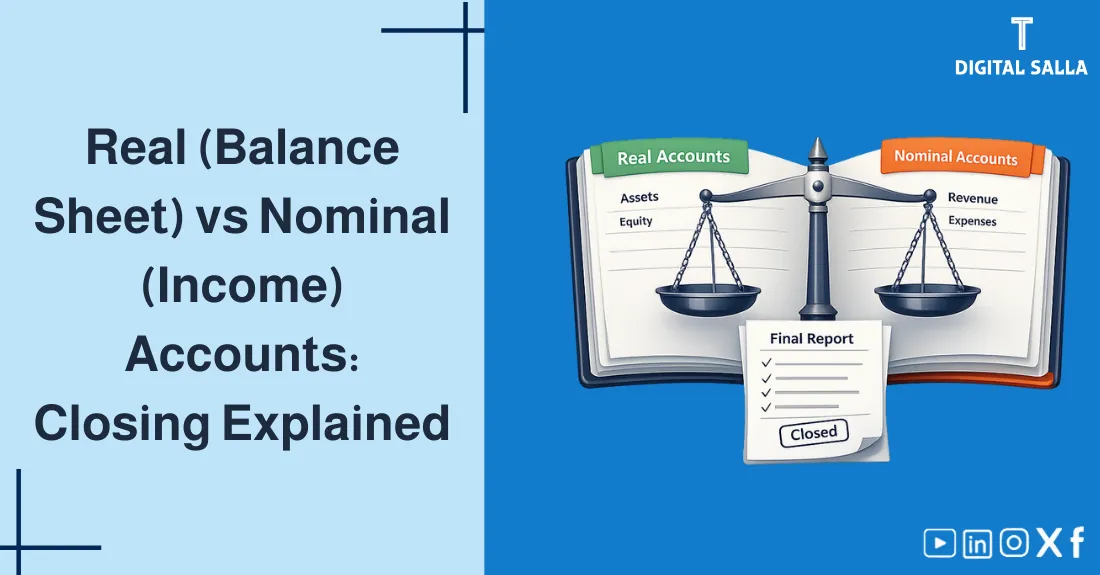

- Real Accounts: Permanent accounts that carry their balances from one fiscal year to the next. They represent the “Standing” of the company.

- Nominal Accounts: Temporary accounts that are reset to zero at year-end. They represent the “Performance” of the company during a specific period.

2) What are Real Accounts (Permanent)?

These accounts are called “Real” or “Permanent” because their balances are cumulative. If you have $10,000 in the bank on Dec 31, you will still have $10,000 on Jan 1.

- Financial Statement: Balance Sheet.

- Examples: Cash, Inventory, Equipment, Accounts Payable, Loans, Capital.

- Balance Goal: To show what the company owns and what it owes at any given moment.

3) What are Nominal Accounts (Temporary)?

These accounts measure activity over a specific period (e.g., a year or a month). At the end of that period, we “drain” their balances into the Equity section to start a clean measurement for the new period.

- Financial Statement: Income Statement.

- Examples: Sales Revenue, Rent Expense, Salaries, Utilities, Dividends.

- Balance Goal: To measure the Net Profit or Loss for the period.

4) Key Comparison Table

| Feature | Real (Permanent) Accounts | Nominal (Temporary) Accounts |

|---|---|---|

| Nature | Cumulative (Continues) | Period-specific (Closed) |

| End of Year | Balances carry over | Balance reset to zero |

| Report | Balance Sheet | Income Statement |

| Goal | Financial Position | Operational Results (Profit/Loss) |

5) Data Workflow: Closing the Year

6) The Concept of Closing (Why do we reset to zero?)

Imagine if a runner didn’t reset their stopwatch after the first lap. They wouldn’t know how fast they ran the second lap!

Journal Entry Tracker - Excel Template

- Isolation: We close accounts to isolate the results of each year.

- Transfer: The profit belongs to the owners, so it must be moved from “Sales/Expenses” to “Equity” on the Balance Sheet.

- Ready for Jan 1: To start the new year with a fresh record for sales and costs.

7) Practical Example: Closing Entries

Assume your company has $10,000 in Revenue and $7,000 in Expenses.

| Step | Journal Entry (Debit / Credit) | Result |

|---|---|---|

| 1) Close Revenues | Dr. Revenues 10,000 Cr. Income Summary 10,000 |

Revenue account is now zero. |

| 2) Close Expenses | Dr. Income Summary 7,000 Cr. Expenses 7,000 |

Expenses account is now zero. |

| 3) Close Summary | Dr. Income Summary 3,000 Cr. Retained Earnings 3,000 |

Profit is moved to the Balance Sheet. |

9) Common Mistakes in Classification

Truth: Dividends are a Nominal Account but they are not an expense; they are a direct reduction of Equity. They are closed directly to Retained Earnings.

10) Frequently Asked Questions

Are Liabilities real or nominal accounts?

Real accounts. Your debts to the bank don’t disappear just because the year ended!

What happens if I forget to close nominal accounts?

Your next year’s profit will be wrong (it will include previous years), and your Balance Sheet will be incomplete because profit wasn’t moved to Equity.

11) Conclusion

Distinguishing between Real and Nominal accounts is the foundation of an accurate accounting cycle. Real accounts represent your standing (Balance Sheet), while Nominal accounts measure your speed (Income Statement). By mastering the closing process, you ensure that every fiscal year starts clean, and every penny of profit is correctly attributed to the owners’ equity.