Elements of Industrial Costs: Direct Materials, Labor, and Manufacturing Overhead (MOH)

Elements of Industrial Costs: Explanation of Direct Materials, Direct Labor, and Manufacturing Overhead (MOH), and how to calculate the prime cost and link it to product pricing and performance control—Digital Basket.

Relevant Costs: How do you make a “make or buy” decision?

Relevant Costs: How do you distinguish between sunk costs and avoidable costs and add opportunity cost to make a make-or-buy decision with realistic figures—Digital Basket.

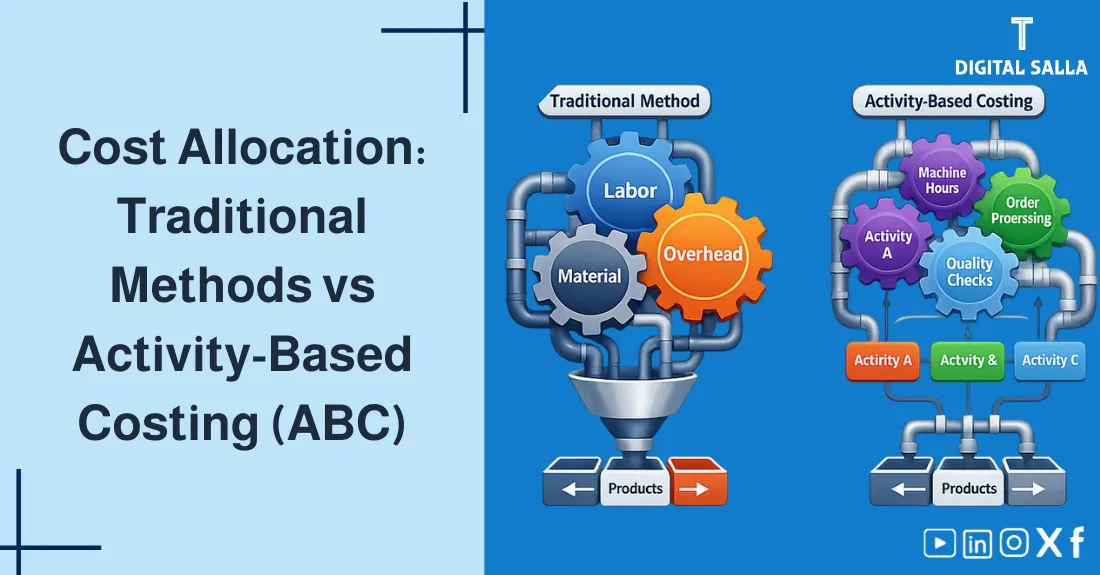

Cost Allocation: Traditional Method vs Activity-Based Costing (ABC)

Cost Allocation: Comparing the Traditional Method with ABC Costing (Activity-Based Costing), and how to determine the loading rate and use cost centers to fairly allocate costs and improve pricing decisions—Digital Basket.

Pricing Strategies: Cost-Plus Pricing vs Market Value

Pricing Strategies: Comparing cost-plus pricing with market-based pricing, and how to build pricing policies that achieve an appropriate margin without losing competitiveness, with practical examples—Digital Basket.

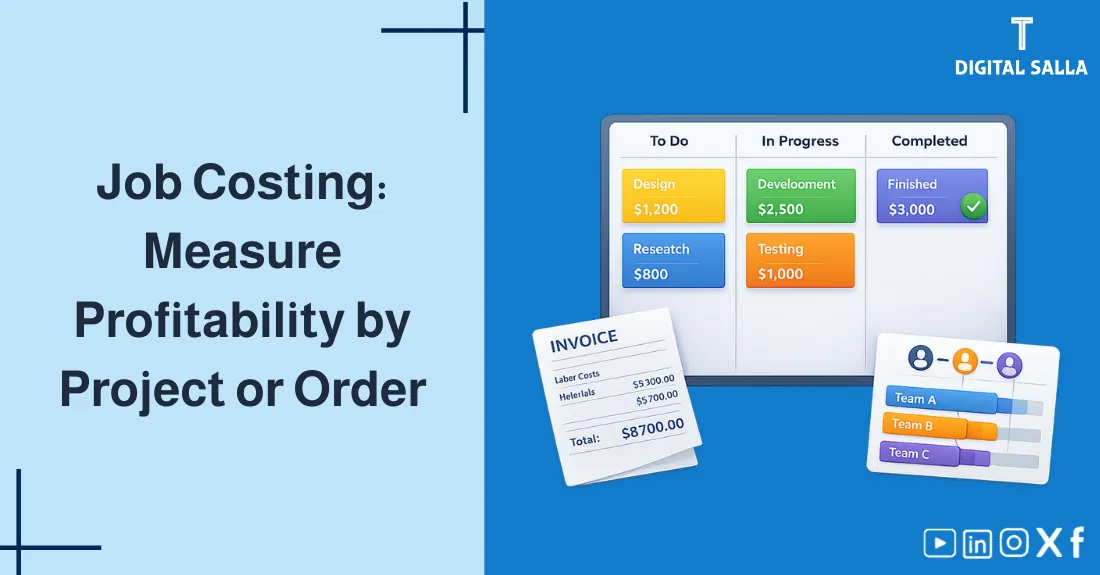

Job Costing System: How to Calculate the Profitability of Each Project or Order Individually?

Job Order Costing: How to Calculate the Cost of an Order and the Profitability of Each Project Individually Using a Cost Card, with Steps for Accurately Assembling Materials, Labor, and Indirect Costs—Digital Basket.

Decisions to discontinue a production line or product: When is discontinuation profitable and when is it destructive?

Decision to discontinue a production line: How do you assess product profitability through segment analysis? And what costs can truly be avoided? A guide to help you know when discontinuation is profitable and when it is destructive to profits—Digital Basket.

Process Costing System: Calculating Unit Cost in Continuous Production Factories

Process Costing: Calculating Unit Cost in Continuous Production Through the Concept of Equivalent Production, and How to Prepare a Production Report and Distribute Costs Among Stages for Accurate Costing—Digital Basket.

Special orders: When do you accept to sell your product at a lower price than usual?

Pricing special orders: When do you accept or reject an order at a lower price? Learn to determine the minimum price based on variable costs and idle capacity, with a decision model that prevents hidden losses—Digital Basket.

Standard Costing: How to Set Performance Standards and Measure Efficiency?

Standard Costing: How to Set Planned Costs and Performance Standards? Use the Standard Cost Card to Measure Efficiency, Analyze Variances, and Take Continuous Improvement Actions—Digital Basket.

Scrap & Spoilage Treatment: When Does the Product Bear It and When Is It Considered a Period Loss?

Scrap & Spoilage Treatment: The Difference Between Normal and Abnormal Spoilage, and When the Product Bears the Scrap Cost and When It Is Treated as a Period Loss, with Its Impact on Quality Cost and Profitability—Digital Basket.

Budgeting and Advanced Financial Analysis (Budgeting & FP&A)

Budgeting: An Introduction to Budgeting & FP&A Explaining Budget Preparation, Financial Planning, and Building a Forecast Budget to Direct Resources, Monitor Performance, and Make Proactive Decisions—Digital Basket.

Annual Budget Preparation (Master Budget): A step-by-step guide from sales to pro forma statements

Master Budget Preparation: A step-by-step guide starting with the sales budget, then the production budget, and the cash budget up to the pro forma statements, with a method to link the tables to produce a cohesive budget—Digital Basket.

Types of Budgets: Zero-Based Budgeting (ZBB) vs Flexible Budgeting

Types of Budgets: Comparing Zero-Based Budgeting (ZBB) with Flexible Budgeting and Fixed Budgeting, and when to choose each type based on your activity nature and demand fluctuations—Digital Basket.

Rolling Forecasts: Why is it the modern alternative to rigid budgeting?

Rolling Forecasts: Why is it an alternative to rigid budgeting? Learn the mechanism of periodically updating the budget and building flexible planning that adapts to changes and provides more accurate liquidity management—Digital Basket.

Free Cash Flow (FCF): The fuel for valuation, how to calculate it accurately?

Free Cash Flow (FCF): How to accurately calculate FCF? And why is it the fuel for valuation in Discounted Cash Flow (DCF). Explanation of formulas, components, and common errors that mislead value—the digital basket.

Financial Analysis and Performance Evaluation: Reading Beyond the Numbers

Financial Analysis Helps You Read Beyond the Numbers: How to Read Financial Statements and Evaluate Financial Performance Using Financial Ratios and Financial Analysis Tools to Make Better Decisions—Digital Basket.

Valuation with Market Multiples (Comparable Multiples): When to use P/E and when EV/EBITDA?

Profit Multiples: When to use the P/E ratio and when EV/EBITDA? And how to read the sales multiple and apply Comparable Multiples to evaluate startups and mature companies without exaggerations—the digital basket.

Vertical and Horizontal Analysis: Uncovering Trends and Financial Structure

Learn Vertical and Horizontal Analysis: Comparative and Common Size Analysis to Uncover Trend Analysis, Revenue Growth, and Cost Structure, with Practical Examples from Statements—Digital Basket.

Feasibility Studies: Using NPV and IRR to make investment decisions

Financial Feasibility Study: How to use Net Present Value (NPV) and Internal Rate of Return (IRR) and the payback period to make investment decisions, with steps for risk assessment and assumptions to ensure realistic results—the digital basket.

Liquidity Ratios: Current Ratio, Quick Ratio, and Working Capital (In-Depth Analysis)

Liquidity Ratios: Explanation of the Current Ratio, Quick Ratio, and Working Capital, and How to Measure the Ability to Pay and Identify Liquidity Risks Early with Practical Interpretation for Each Ratio—Digital Basket.

Sensitivity and Scenario Analysis: Stress Testing the Company’s Resilience

Sensitivity Analysis: How to build scenario analysis and apply stress testing to measure financial risks? Learn to identify critical variables and their impact on profitability and liquidity before making a decision—the digital basket.

Profitability Ratios: Gross, Operating, and Net Margins, and ROA/ROE

Profitability Ratios: How to Calculate Gross, Operating, and Net Profit Margins, and Interpret ROA and ROE and Operating Margin to Evaluate True Performance and Compare It with Competitors—Digital Basket.

DuPont Analysis: How to Break Down Return on Equity to Discover the Secret of Profit?

DuPont Identity: Breaking Down ROE into Components—Profit Margin, Asset Turnover, and Financial Leverage—to Identify the Source of Strength or Weakness in Performance and Determine What Needs Improvement—Digital Basket.

Solvency and Debt Ratios: Is the company able to survive and repay its long-term debts?

Solvency Ratios: Measuring debt ratio, financial leverage, and interest coverage to assess financial risks and the company's ability to survive and repay long-term debts, with important warning signs—Digital Basket.

Efficiency Ratios: Inventory turnover, collection (DSO), and payment (DPO)

Efficiency Ratios: Calculating inventory turnover, Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), and asset turnover to measure operational efficiency, improve cash cycle, and reduce working capital—Digital Basket.

Cash Conversion Cycle: The secret behind Amazon and Apple’s liquidity

Cash Conversion Cycle: How to measure collection period, payment period, and inventory turnover to understand liquidity management—and why companies like Amazon and Apple may achieve strong liquidity through the cycle—Digital Basket.

Earnings Quality: How to discover “paper” profits and accounting manipulation?

Earnings Quality: How to differentiate between paper profits and cash-backed profits? Learn indicators of earnings management, link operating cash flow to earnings sustainability, and detect accounting manipulation—Digital Basket.

Non-recurring Items: How to isolate them to assess true performance?

Non-recurring Items: How to isolate extraordinary income, incidental items, and non-operating profits to normalize earnings and assess true performance without accounting noise—Digital Basket.

Writing a Management Commentary: How to turn numbers into a story and decision?

Management Commentary: How to turn numbers into a story and decision? Learn to structure the presentation of financial results, build a financial dashboard, and write variance analysis in a language management understands—Digital Basket.

Financial Modeling & Valuation

Financial Modeling: A comprehensive introduction to Financial Modeling & Valuation, from building financial models and Excel Modeling to feasibility studies and financial planning, with a practical framework preparing you for investment decisions—Digital Basket.