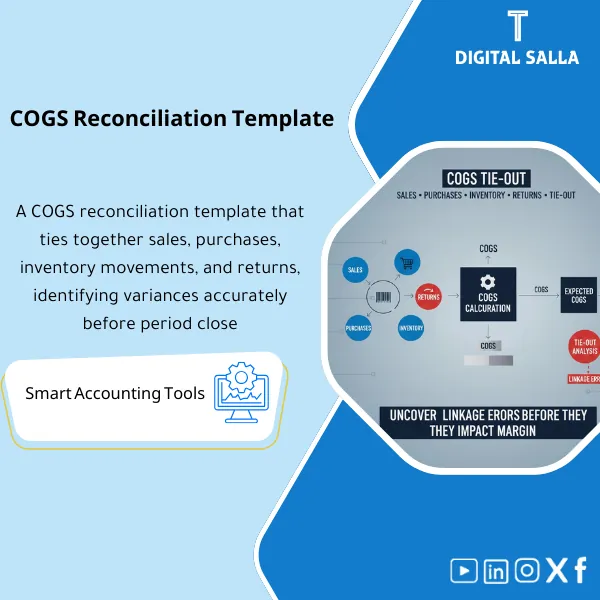

COGS Reconciliation – Excel Template

42.29 $

COGS Reconciliation: Ties sales to purchases, inventory and returns using the inventory equation (opening/closing) to validate gross margin. Delivers a COGS variance report with explanations for CFO review before approving monthly statements.

Cost of Goods Sold Reconciliation

The COGS Reconciliation template links sales/inventory/purchases/returns to the Opening/Closing inventory equation and produces a margin variance analysis + a deliverable variance list (Excel).

Value Proposition: A single template that substantiates the COGS figure from the inventory equation to the GL and answers “Why did the margin change?” with evidence, not guesswork.

Practical Definition: Cost of Goods Sold Reconciliation is the transformation of the COGS figure from a “report output” into a traceable reconciliation file: it starts from the Opening/Closing inventory equation, links it to purchases and returns and inventory movements, then performs COGS reconciliation with inventory and with account balances in the GL. In companies (Retail / E-com / Distribution), the problem is often not the “calculation of COGS” itself; the issue is errors in linking sales to inventory (non-stock items, returns that do not reflect COGS, transfers between warehouses, incomplete pricing, or movements without cost) leading to unexplained margin variances. This template provides you with a complete COGS Reconciliation with reviewable outputs.

In 20 Seconds: What Will You Get?

- COGS Reconciliation ready to link COGS to the Opening/Closing inventory equation.

- A detailed schedule for COGS reconciliation with inventory and an explanation of any variances against the GL.

- An analysis of the impact of returns on COGS (Sales returns / Purchase returns) in a separate table.

- An exception log to identify errors in linking sales to inventory (Items without cost/Incorrect mapping/Negative inventory).

- Margin variance analysis (Margin Bridge) illustrating the difference: Volume/Price/Cost/Returns/Adjustments.

- A posting list for correction entries (Reclass/Adjustments) with clear references.

- A sign-off pack for delivery to the Chief Accountant/Auditor (Prepared/Reviewed/Approved).

CTA related to outputs: You will receive COGS Reconciliation + Margin Bridge + Exception Log + Posting List.

Suitable For

- Cost/Inventory Accountant: Proving COGS and linking it to inventory and movements while addressing margin variances.

- Chief Accountant / Month-End Owner: Tie-out the COGS figure with the GL and close it with justified reconciliations.

- Internal Audit / External Audit Support: Evidence file: Inventory equation + Returns impact + Variance explanations.

Not Suitable For

- If your company manufactures with WIP and allocates manufacturing costs (Overheads/Absorption) without production data and standard costs — you will need a specialized manufacturing cost package.

- If you do not have Opening/Closing inventory values or extractable purchase/sales reports — reports must be adjusted first before running the reconciliation.

Without Reconciliation / With Cost of Goods Sold Reconciliation Template (Brief Comparison)

| Item | Without Template | With Template |

|---|---|---|

| COGS Figure | A figure from a report/GL without explanation | COGS Reconciliation based on the inventory equation + supporting schedules |

| Returns | Unclear impact on COGS | Returns impact schedule on COGS + named variances |

| Margin | “Margin fluctuates” without reason | Margin variance analysis (Bridge) + Exception log |

Before Use: 5 Symptoms That Your COGS is “Unexplained”

- The margin fluctuates monthly without a clear change in prices or sales.

- COGS in the GL does not equal COGS according to the Opening/Closing inventory equation.

- Returns are recorded as negative sales but COGS does not reflect the same logic.

- There are inventory movements without cost or Negative inventory distorting the cost of goods sold.

- Discrepancies between sales and inventory reports due to errors in linking sales to inventory (Item mapping / UOM / non-stock items).

How Does Cost of Goods Sold Reconciliation Work Practically from Start to Finish?

The operation begins by establishing the inventory equation: Opening Inventory + (Net Purchases/Receipts) − Closing Inventory = Expected COGS.

Then, purchases are “disassembled” (GR/IR against invoices), returns are separated (Customer/Supplier) and linked to their impact on inventory and COGS,

followed by comparing Expected COGS with the COGS recorded in the GL and extracting variances by type: pricing variances, timing variances (Cut-off), inventory reconciliation variances, or linking errors.

In the end, the template produces a COGS reconciliation file with variance explanations + a posting list for specific adjustments, not a total entry.

Application Method (3 Steps)

Step 1: Preparation and Gathering Reports

- Opening/Closing inventory value (Subledger) + inventory account balance in the GL for the same date.

- Purchases/Receipts: GRNs/receipts + supplier invoices + GR/IR (if applicable).

- Customer sales and returns + any related Credit Notes.

- Significant inventory movements: adjustments, write-offs, transfers, cycle count variances.

- TB/GL extract for accounts: Inventory, COGS, PPV/variances, adjustments.

Step 2: Reconciliations + Matches + Error Disclosure

- Aggregate net purchases and link them to what was actually received (GR/IR tie-out if available).

- Separate the impact of returns on COGS (Did the return restock inventory? Did it reverse COGS?).

- Disclose errors in linking sales to inventory: non-stock items, UOM mismatch, zero cost, sales without issuance.

- Generate an Exception log + identify the owner of the action (Warehouse/Procurement/Finance).

Step 3: Adjusted COGS + Margin + Delivery File

- Output Expected/Adjusted COGS according to the Opening/Closing inventory equation.

- Match COGS with the GL and show the Bridge for variances by reason.

- Output Margin Variance Analysis + Posting list for correction entries (Reclass/Adjustments) with references.

- Closing pack: schedules + exceptions + sign-off + archiving map.

Product Components (Clear Inventory)

-

COGS Equation Schedule (Opening/Closing)

- Practical Purpose: Establishing the Opening/Closing inventory equation and producing Expected COGS.

- When to Use: At the beginning of Month-End/Year-End.

- Resulting Evidence: inventory rollforward + expected COGS.

-

Purchases & Receipts Tie-out (GR/IR optional)

- Practical Purpose: Separating “accounting purchases” from “actual receipts” and identifying cut-off variances.

- When to Use: When GR/IR exists or there is a discrepancy between invoices and receipts.

- Resulting Evidence: purchases bridge + unmatched receipts/invoices list.

-

Sales & Returns Impact (Impact of Returns on COGS)

- Practical Purpose: Establishing whether the return restocked inventory? And did it reverse COGS? Identifying any variances.

- When to Use: Every month, especially in sectors with high returns.

- Resulting Evidence: returns impact schedule + exceptions.

-

Inventory Movements & Adjustments Register

- Practical Purpose: Compiling significant adjustments: write-offs, inventory variances, transfers, adjustments.

- When to Use: Before finalizing COGS.

- Resulting Evidence: adjustments register linked to entry/document numbers.

-

GL Tie-out (COGS Reconciliation with Inventory)

- Practical Purpose: Comparing Expected/Adjusted COGS with COGS in the GL and showing variances.

- When to Use: At closing.

- Resulting Evidence: tie-out report + variance bridge.

-

Exception Log (Errors in Linking Sales to Inventory)

- Practical Purpose: Disclosing cases: zero cost, Negative inventory, UOM mismatch, non-stock sales, sales without issue.

- When to Use: During reconciliation and before finalizing results.

- Resulting Evidence: exception tracker with owner/action/date of closure.

-

Margin Variance Bridge (Margin Variance Analysis)

- Practical Purpose: Explaining margin changes to drivers: price/volume/cost/returns/adjustments.

- When to Use: After establishing COGS and linking it to sales.

- Resulting Evidence: margin bridge that can be presented to management or auditors.

-

Posting List & Sign-off Pack

- Practical Purpose: Producing correction entries (Reclass/Adjustments) + signing Prepared/Reviewed/Approved.

- When to Use: The last step before closing the period.

- Resulting Evidence: posting list + closing pack.

What Should Be Included in the Delivery?

- 01-COGS-Reconciliation-Pack.xlsx: The main file (Equation + Tie-out + Bridge + Exceptions).

- 02-Inventory-Rollforward.xlsx: Opening/Closing inventory equation + Expected COGS.

- 03-Purchases-Receipts-Tieout.xlsx: Purchases/Receipts + GR/IR (optional) + unmatched list.

- 04-Sales-Returns-Impact.xlsx: Impact of returns on COGS + separation of customer/supplier returns.

- 05-Inventory-Adjustments-Register.xlsx: write-off / inventory / transfers / adjustments affecting COGS.

- 06-GL-Tieout.xlsx: COGS reconciliation with inventory against GL (Inventory + COGS + variances).

- 07-Exceptions-Log.xlsx: Errors in linking sales to inventory + closing plans and responsibilities.

- 08-Margin-Variance-Bridge.xlsx: Margin variance analysis (Price/Volume/Cost/Returns/Adjustments).

- 09-Posting-List-JEs.xlsx: Variance/Reclass entries + references for each variance with explanations.

- 10-Controls-Checklist.pdf: Controls checklist: cut-off/returns mapping/negative inventory/tie-out.

- 11-Runbook.pdf: Step-by-step operation (Prepare → Reconcile → Explain → Post → Sign-off).

- 12-Signoff-Page.docx: Prepared/Reviewed/Approved (Finance/Inventory/Head of Accounts).

- 13-Archiving-Map.docx: Evidence retention tree (ERP reports + schedules + exceptions + entries).

- 14-Management-Summary.pdf: Executive summary: Reasons for margin changes, open variances, and actions.

After Implementation (Just Two Points)

- Operational Outcome for the Team: The COGS figure transforms from a “report” into a reconciliation file: Equation + Returns + Adjustments + Tie-out + Posting list.

- Control/Audit Outcome: Clear traceability: Opening/Closing + Purchases/Movements + Impact of Returns + Variance Explanations + Sign-off and Approval.

FAQ — Questions Before Purchase

Is the template suitable for any ERP/POS/WMS?

Yes, provided you can extract: Opening/Closing inventory value, Purchases/Receipts, Sales/Returns, and GL balances.

Does it support multiple warehouses/branches?

Yes, as long as the data includes Warehouse/Branch dimension, reconciliation and analysis can be separated by each warehouse/branch.

Does it clearly include the impact of returns on COGS?

Yes, there is a separate table that establishes the impact of Sales returns and Purchase returns on inventory and COGS, highlighting cases that were not reflected.

What is the minimum data required to get started?

Opening inventory + Closing inventory + Purchases/Receipts + Sales/Returns + TB/GL (Inventory/COGS/Adjustments).

Is it suitable for monthly closing only or also for annual closing?

For both: the same COGS Reconciliation works monthly, and the annual process follows the same methodology but with greater scrutiny on cut-off and exceptions.

Does it address errors in linking sales to inventory?

It presents them as exceptions (Items without cost/Non-stock sales/UOM mismatch/Sales without issue/Negative inventory) with a tracking list.

Is there a ready posting list for correction entries?

Yes: Posting list for variance/Reclass entries with a reference for each variance (at the reason level, not “one entry”).

Is it suitable for manufacturing?

It is suitable for simple manufacturing if the cost of inventory and COGS is clear and archived, but it does not cover WIP/Overheads/BOM as a complete manufacturing package.

Ready to substantiate COGS with the inventory equation and provide an explanation for the margin instead of “unknown variances”?

Outputs: COGS Reconciliation + Opening/Closing inventory equation + Impact of Returns + Margin Variance Analysis + Exception Log + Posting List.

| المسمّى الوظيفي | |

|---|---|

| Duration | |

| المستوى | |

| التحديثات | |

| القطاع | |

| الصيغة |

Reviews

Clear filtersThere are no reviews yet.