Accounting Documents Visual Guide – PDF Files + Images

127.39 $Key Accounting Documents (with Images): A practical visual guide to reading, understanding, and using the most common accounting documents—highlighting key figures and the correct accounting treatment for effective financial management.

Chief Accountant Reference Guide – PDF File

68.88 $Key Accounting Insights for Chief Accountants: A practical Excel file containing 99 advanced insights and lessons learned to avoid common errors and improve the accuracy and efficiency of accounting operations and financial reporting.

CIT Computation & Tax Reconciliation – Excel File

111.44 $CIT Calculation: Bridges accounting profit to taxable base using permanent/temporary differences and non-deductible items with references. Delivers an audit-ready corporate income tax computation for annual filing.

Closing Handover Kit – Excel Template

55.59 $Monthly Close File (Close Pack): Consolidates adjustments, reconciliations, journal memos, and evidence links into a standardized close pack for each period. Delivers a handover-ready package for management review and auditor inspection.

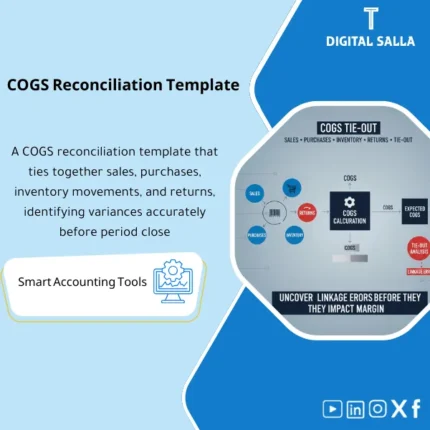

COGS Reconciliation – Excel Template

42.29 $COGS Reconciliation: Ties sales to purchases, inventory and returns using the inventory equation (opening/closing) to validate gross margin. Delivers a COGS variance report with explanations for CFO review before approving monthly statements.

Deferred Tax Model – Excel File

84.84 $Deferred Tax Template: Tracks temporary differences and calculates DTA/DTL with rollforwards and linkage to P&L/OCI. Delivers an auditable deferred tax schedule for IFRS reporting teams.

EOSB Accrual Rollforward – Excel Template

42.29 $End-of-Service Provision (EOSB): Calculates EOSB liability and manages annual movements (Opening/Accrual/Utilization) with accounting journals and direct financial statement impact. Delivers rollforwards and adjustment memos ready for annual close by payroll and finance teams.

Financial Statements Builder – Excel File

63.56 $Simple Excel Financial Statements Tool helps companies prepare internal financial statements quickly and easily. Paste the trial balance and generate automatically updated statements, with editable classifications and a guidance file to ensure accuracy.

JE Correction Workflow – Excel Template

34.31 $Journal Entry Correction Template: Documents reversals/reclasses with root cause, links original entries to corrections, and enforces a clear approval workflow. Delivers an approved corrections register suitable for audit files when close errors are discovered.

Journal Entry Tracker – Excel Template

34.31 $Journal Entry Tracker: Logs JE number, rationale, review/approval status, attachment completeness, and linkage to the close period. Delivers a delivery-ready JE list within the Close Pack for accounting and audit teams.

Payroll Adjustments & Accounting Impact – Excel File

55.59 $Payroll Adjustments Register: Documents retro adjustments, deductions, allowances, and employee advances with justification, approval, and linkage to GL entries. Delivers a controlled adjustments log and clear settlement journals before close.

Recurring Expenses Accrual + JEs – Excel File

63.56 $Recurring Expenses Accrual: Recognizes rent, utilities, and subscriptions monthly via accruals with reversing entries and settlement upon invoice receipt. Delivers movement schedules and close journals to stabilize period expenses.

Standard Chart of Accounts – Excel File

84.84 $Chart of Accounts Template (Excel): A professionally structured and flexible CoA aligned with IAS/IFRS, including clear guidance and practical use cases for each account. Enables accurate posting, reliable financial statements, and KPI-driven performance analysis.

Tax Provision Summary – Excel File

63.56 $Income Tax Provision (Current/Deferred): Summarizes current and deferred tax and links to journals (tax expense, tax payable, deferred tax) with movement schedules. Delivers a tax close file and a disclosure-ready note for annual reporting.

Vacation Accrual Rollforward – Excel Template

42.29 $Leave Provision: Converts leave day balances into a monetary liability with annual movement tracking and accrual journals, linked to daily cost rates. Delivers rollforwards and close memos for HR and finance teams at year-end and periodic close.

VAT Reconciliation Model – Excel File

42.29 $VAT Reconciliation: Links the GL to sales/purchase invoice registers and VAT return references with a variance table, root causes, and correction actions. Delivers a reconciliation file ready before VAT filing for monthly/quarterly compliance.